I Ain't Gonna Play Sun City

/I'm sure there are many people, particularly the younger generation, seeing their Tumblr, news feeds and Facebook walls blow up with Nelson Mandela tributes and who, while recognizing the name, still wonder what's the big deal. We've all read in our history books about some of the heinous treatment of one people by another and because these are history books we get the sense that by and large humanity has evolved past such acts. Sure we hear short snippets in the news of atrocities such as genocide, slavery and ethnic and religious purges taking place today, but they always seems to take place in far off countries and often among people that don't look or act like us so it feels pretty distant. Sadly, this is human nature. I grew up in era where Apartheid was legal in South Africa, and proudly so, at least as characterized by some of its country's leaders. While South Africa was far away and many of its people didn't look like us, many of the leaders spouting support for institutionalized hatred looked a lot like us and spoke our language on the newscasts. With the emergence of cable news and 24-hour news cycles, it was hard to escape the reality that people like us were still pursuing heinous policies against others. During my formative years apartheid moved from being a distasteful policy perpetrated in some far-off land to the forefront of our consciousness.

For many US generations, college has been a place where political activism takes hold and it's no coincidence that some of the most compelling moments in political protests, such as those against the war in Vietnam or those in support of Civil Rights, took place on college campuses. But my '80s college generation wasn't exercised about much. We complained about the labeling of "dangerous" music and our musical heroes produced music videos expressing fear of nuclear war, but for the most part our economy was humming along and we were apathetic. Until apartheid. I can't say that I joined marches or protests against apartheid because I don't recall any being organized at my school, but I can say we cared, and cared deeply.

There are no conversations as fascinating and wide ranging as those that take place in college dorm corridors at 3 AM, punctuated by kids who are invincible, who know just enough of politics and world events to be dangerous and who are still supremely confident that they have all the answers to solve the problems foisted upon us by earlier generations. We would debate apartheid and declare that had we been in charge we would never have allowed it to take root, and if we could have our way now we'd eradicate it, though we didn't know how. These conversations crossed racial, political and socio-economic lines, in part because many of us hadn't yet established our own personal ideologies and selected our lifelong news sources that would comfortably reinforce our own biases. From our business and economics classes we understood that the issues were probably more nuanced than "simple" hatred by one race of another -- and make no mistake, there were business and world leaders and emerging leaders of our own generation supporting apartheid at that time, or at least not condemning it because South Africa served their commercial interests. But for most of us, it was a black and white issue - pun intended, but no disrespect intended.

Our musical idols provided some measure of assistance, by refusing en masse to play Sun City, at that time popular stop on many global concert tours. And we radio station geeks would both play the relevant anthems ("Little Steven" Van Zandt and Artists United Against Apartheid "I Ain't Gonna Play Sun City" comes to mind) and refuse to play music from artists who continued to tour South Africa (I'm looking at you Elton John and Queen, among others) though admittedly our gnat-like memories faded when hot new songs by these artists were released. But to the extent we cared about global politics and human rights in that era, apartheid was the subject of our activism. And Nelson Mandela figured prominently in the conversation.

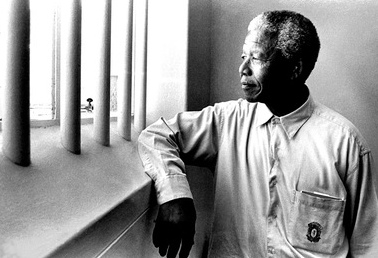

Mandela was released from prison after I graduated, and while the task of earning a living replaced my late night world-problem-solving discussions, none of us could help but be aware, and impressed by, the towering intellect, passion, strength and, yes, compassion, of this man who had spent nearly three decades incarcerated for his stand against his government's injustices.  Let's ponder that for a second. There are notable movies illustrating how those incarcerated for long periods often struggle with returning to society. And of late there is a seemingly constant stream of wrongly-convicted prisoners released after DNA evidence clears them, typically years if not decades later, and unfailingly the vibrant young people who went to jail emerge as broken shells after a lifetime of imprisonment. And yet Mandela emerged with an unbroken spirit, ready to catalyze the movement to finally ban apartheid. He then led his country after an election in which he earned over 62% of the votes, one of the most stunning reversals of fortune I've observed in my lifetime. He did not act alone. There were, of course, many others, whose names won't be recorded in the history books, fighting apartheid. But Nelson Mandela is not, for me and for many (and hopefully most) of my generation, some distant history book reference; he's the embodiment of what one person can do to fight injustice on a scale that seems impossibly insurmountable.

Let's ponder that for a second. There are notable movies illustrating how those incarcerated for long periods often struggle with returning to society. And of late there is a seemingly constant stream of wrongly-convicted prisoners released after DNA evidence clears them, typically years if not decades later, and unfailingly the vibrant young people who went to jail emerge as broken shells after a lifetime of imprisonment. And yet Mandela emerged with an unbroken spirit, ready to catalyze the movement to finally ban apartheid. He then led his country after an election in which he earned over 62% of the votes, one of the most stunning reversals of fortune I've observed in my lifetime. He did not act alone. There were, of course, many others, whose names won't be recorded in the history books, fighting apartheid. But Nelson Mandela is not, for me and for many (and hopefully most) of my generation, some distant history book reference; he's the embodiment of what one person can do to fight injustice on a scale that seems impossibly insurmountable.

For that, I am pleased to have been a witness. And I hope my daughters, nieces and nephew, some of whom are of mixed race, and others in the younger generations take a moment to study and reflect on Nelson Mandela's accomplishments (some already have). There's been some muttering about the disproportionate air time devoted to a popular film star who died tragically this week and what an injustice it is that Nelson Mandela's passing isn't generating nearly as much viral attention. I bear no grudge against the media, or the young film fans, who can't get enough news of their deceased movie star. But trust me, when all is said and done, Nelson Mandela, both his life and his passing, will have a far greater impact on our social consciousness than any other news we'll read this week. He was, and is, that important.

He had his failings, as we all do, and we'll begin to hear of his imperfections, and rightfully so. It's important to note that our icons put their pants on one leg at a time just like the rest of us, and have weaknesses just as we have. But that doesn't detract from what he accomplished.

Thank you, Nelson Mandela, for what you've done and for showing us how it's done. Rest in peace.

Timothy B. Corcoran delivers keynote presentations and conducts workshops to help lawyers, in-house counsel and legal service providers profit in a time of great change. To inquire about his services, contact him at +1.609.557.7311 or at tim@corcoranconsultinggroup.com.